Qatar Energy Doubles Down on Petrochemicals with Major Expansion in Qatar and the U.S.

- Entity

- Qatar Energy

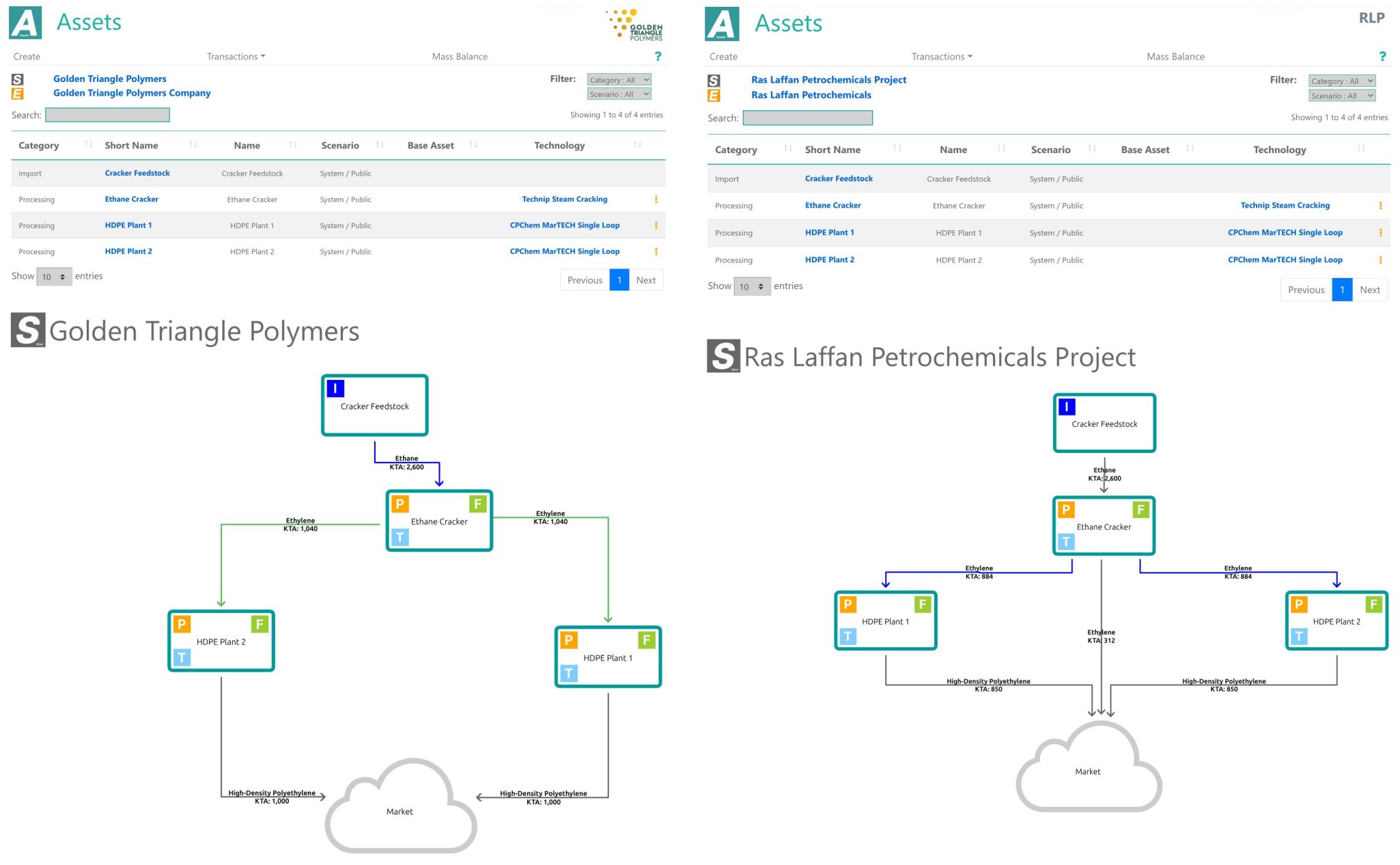

Ras Laffan and Golden Triangle complexes' mass balances, technologies and flow charts | Sites' models by Portfolio Planning PLUS

Qatar Energy is embarking on a major expansion of its petrochemicals business, signaling a transformative phase for the country’s industrial sector and its global energy ambitions. The state-owned company has announced plans to more than double its petrochemical production capacity, with significant investments in both Qatar and the United States. This expansion is centered around the construction of world-scale ethane-based crackers, designed to meet the anticipated surge in global demand for plastics and chemical products as the industry shifts toward cleaner and more efficient energy sources.

At the heart of this strategy is the $6 billion Ras Laffan Petrochemical Complex, currently under construction in Ras Laffan Industrial City, about 80 kilometers north of Doha. This facility will house an ethane cracker with an ethylene production capacity of 2.1 million metric tons per year (MMtpy), making it the largest in the Middle East and one of the largest globally. The complex will also feature two polyethylene trains capable of producing a combined 1.7 MMtpy of high-density polyethylene (HDPE), raising Qatar’s overall HDPE output by about 50% and increasing ethylene production capacity by more than 40%. The project is a joint venture between Qatar Energy, which holds a 70% stake, and Chevron Phillips Chemical (CPChem), which owns the remaining 30%.

The Ras Laffan complex is expected to be operational by the end of 2026, at which point it will propel Qatar’s total petrochemical production capacity to approximately 14 million tons per year. This marks the largest single investment in Qatar Energy’s downstream sector and is a cornerstone of the company’s broader strategy to reinforce its position as a leading global energy player. The project is also notable for its focus on sustainability, with energy-saving technologies and emissions-reduction measures designed to lower the facility’s environmental footprint compared to similar plants worldwide.

Parallel to its domestic expansion, Qatar Energy is also investing heavily in the United States. In partnership with CPChem, the company is developing the Golden Triangle Polymers Plant in Orange, Texas. With a planned ethylene capacity of 2.1 MMtpy and two polyethylene units totaling 2.0 MMtpy, this $8.5 billion facility is expected to be one of the largest of its kind globally. Production is scheduled to commence in 2026, and the bulk of its output will be aimed at export markets, supporting the growing global demand for polyethylene products used in packaging, consumer goods, and industrial applications.

Qatari energy minister and Qatar Energy CEO Saad al-Kaabi said gas will be the world's energy "backbone"

These projects are underpinned by Qatar’s abundant natural gas resources, particularly from the North Field, the world’s largest non-associated natural gas field. The North Field Expansion project, which will increase Qatar’s liquefied natural gas (LNG) production capacity from 77 million to 110 million tons per year, is closely linked to the supply of feedstock for the new petrochemical facilities. Qatar Energy’s integrated approach, leveraging both upstream and downstream assets, is designed to maximize the value of its natural gas reserves and ensure long-term competitiveness in the global energy market.

Qatar Energy’s CEO, Saad Sherida Al-Kaabi, has emphasized that gas will remain a backbone for industry, power, chemicals, and food production for decades to come. He notes that the company’s investments in petrochemicals are a natural extension of its LNG leadership, enabling it to diversify revenues and support the country’s economic development. The projects also reflect a broader industry trend, with petrochemical producers worldwide investing in ethane crackers to capitalize on the availability of low-cost feedstock and to adapt to evolving market dynamics.

In summary, Qatar Energy’s aggressive expansion in the petrochemicals sector—both at home and abroad—signals a new era for the company and the country. By doubling its capacity and investing in state-of-the-art, environmentally conscious facilities, Qatar is positioning itself as a major global hub for petrochemical production, poised to benefit from the long-term growth in demand for plastics and chemical products worldwide.

#qatarenergy #chevronphillips #cpchem #qatar #naturalgas #lng #steamcracking #worldscale #goldentriangle #raslaffan