There will be needs for several mega-refineries to be built every year until 2050

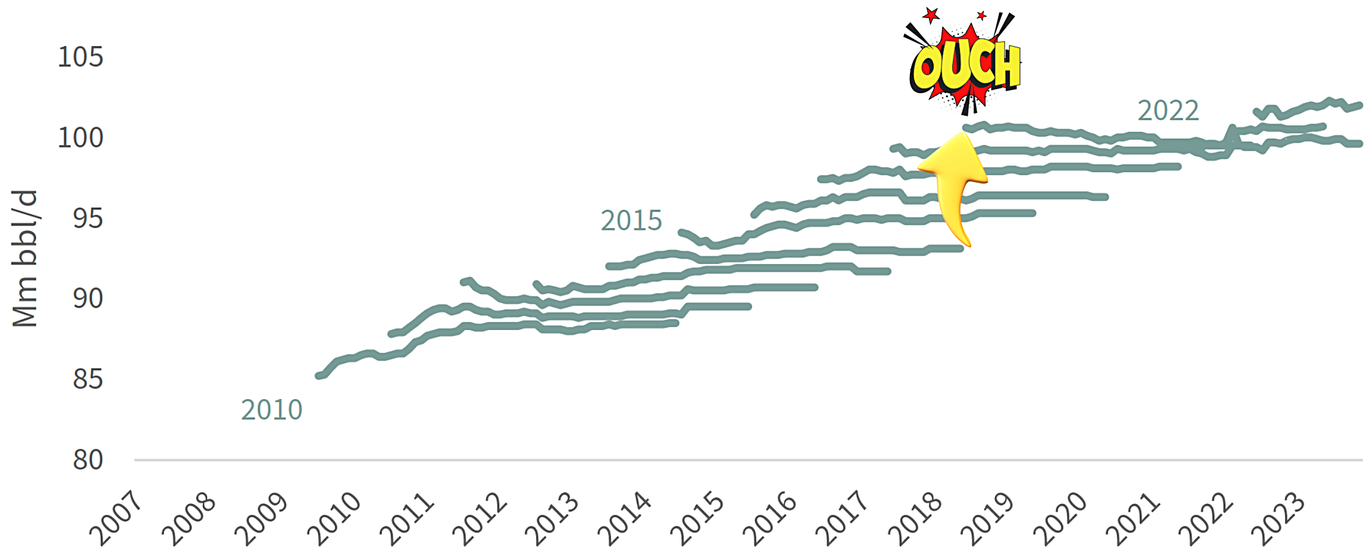

The Revision Bandwagon

One by one, financial companies, energy agencies and international organizations are awakening to an inconvenient reality incompatible with their consensual scenario of an irremediable, imminent crude oil demise, revisiting their peak oil scenario year after year, pushing back the date of irreversible peak demand farther in the future and revising upwards their more proximate demand forecast.

The IEA got the ball rolling in August 2023:

"World oil demand is scaling record highs, boosted by strong summer air travel, increased oil use in power generation and surging Chinese petrochemical activity. Global oil demand is set to expand by 2.2 mb/d to 102.2 mb/d in 2023, with China accounting for more than 70% of growth."

They, of course, unforgivably, provide all the many reasons why oil demand growth is expected to slow down in 2024:

"With the post-pandemic rebound running out of steam, and as lacklustre economic conditions, tighter efficiency standards and new electric vehicles weigh on use, growth is forecast to slow to 1 mb/d in 2024."

That's IEA's usual trick to consistently underreport forward oil demand, displaying long-term forecast performance repeatedly erroneous by considerable deviations.

|

IEA Demand Revisions Over Time, via Goehring & Rozencwajg Associates, LLC, 2023

|

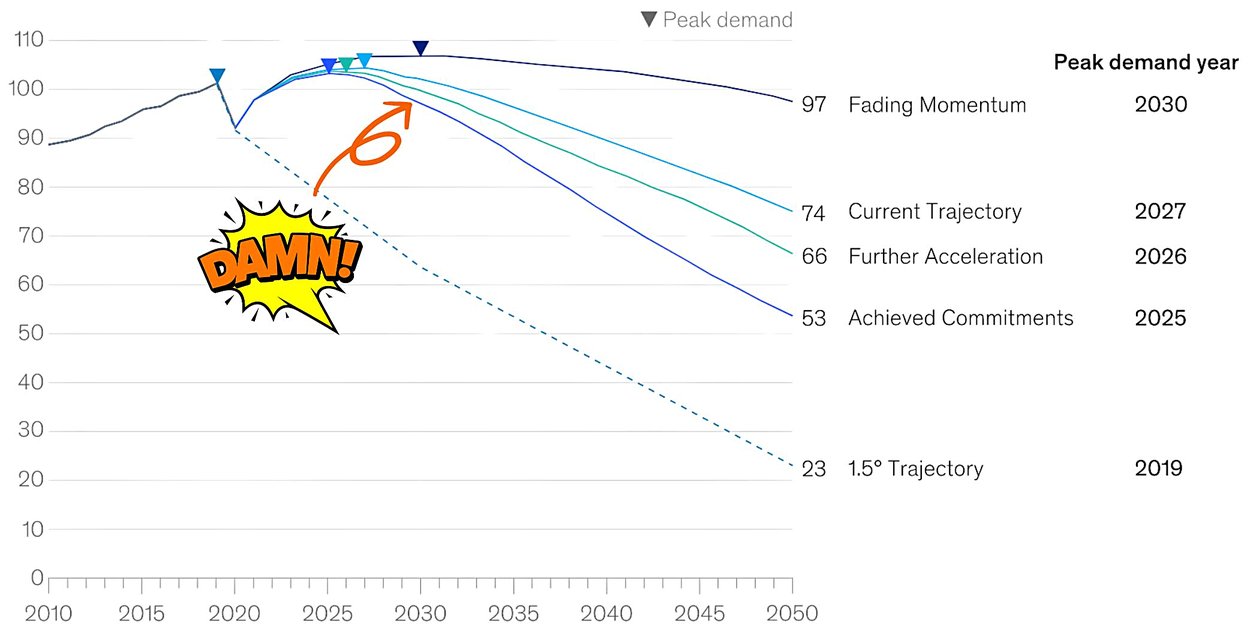

Then it's McKinsey's turn in January 2024:

"Although global oil demand is projected to decline across scenarios, its long-term trajectory remains uncertain. After an increase in global oil demand to pre-2020 levels, our four bottom-up energy transition scenarios suggest that demand would grow at a slower pace before beginning to decline by 2030, due largely to increases in energy efficiency and rapid growth in EV adoption."

|

McKinsey Global Energy Solutions' Global liquids demand outlook by scenario (MMb/d), Jan 2024

|

Despite repeatedly failed predictions on the energy transition, they double and even triple down:

"Given declining oil demand and the move toward low-carbon energy sources, global refining may need to adapt to ensure that it plays a role in the accelerating energy transition."

I must be blindsided to not see the obvious decline in oil demand or to not realizing to what extent the energy transition towards low carbon sources is accelerating.

Maybe less compromised Goldman jumps on the revision bandwagon in May 2024:

"Goldman Sachs has raised its forecast for global oil demand, predicting robust growth until 2034. The investment bank now anticipates crude usage to peak at around 110 million barrels per day (bpd) by that year, largely due to slowing momentum in electric vehicle (EV) sales. This upward revision from the previously expected 106 million bpd by 2030 to 108.5 million bpd underscores the anticipated sustained consumption of oil products in the coming decade."

Phew‼️ I feel reassured.

"The bank's analysts predict that global oil demand will plateau at around 110 million bpd in 2034, followed by a gradual decline at a CAGR of 0.3% until 2040."

Oh‼️ no, not them too❓

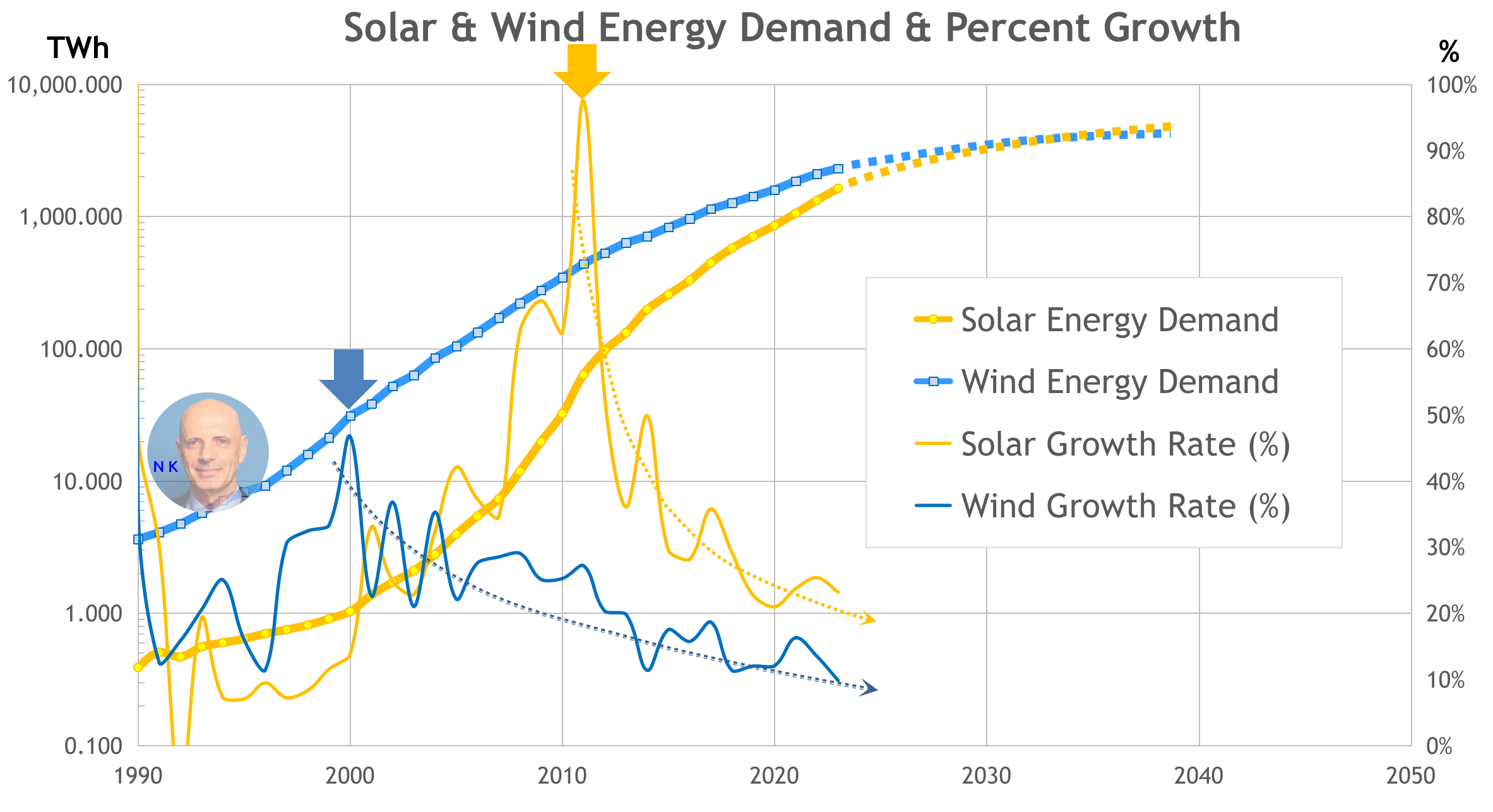

Solar and Wind killed the Petroleum Star

In any case, peak oil demand is at our door step and is the next big think to happen in the energy landscape due to the unstoppable green revolution as wind and solar energy are growing exponentially.

Are they ❓

Not really ‼️

|

Sourced from Our World in Data and based upon data from Ember (2024) and Energy Institute - Statistical Review of World Energy (2023), the growth rate of electricity generated by both wind and solar installations is decreasing since their peak growth rates in respectively 2010 and 2011 until 2023. Exponential growth happens when the growth rate is constant by a factor (a percentage), but when this growth rate decreases, absolute growth is no longer exponential as we already forecasted in the October 2022 article ENERGY TRANSITIONS REBOOT.

As a matter of fact, solar and wind have each added a lesser relative amount of electricity generated compared with the year prior (about 300 GWh in case of solar generation and 250 GWh in case of wind generation for a cumulated total of about 550 TWh). It is also observed that solar energy generation growth is less mature compared with wind energy generation as it peaked more than 10 years later and it is probably going to surpass the later in absolute terms in the years to come, but in any case growth rate attrition will result in renewable energy production to plateau over the next decade and will be flattening beyond 2040, which is not really supportive of the mystical Net Zero wishfull objectives.

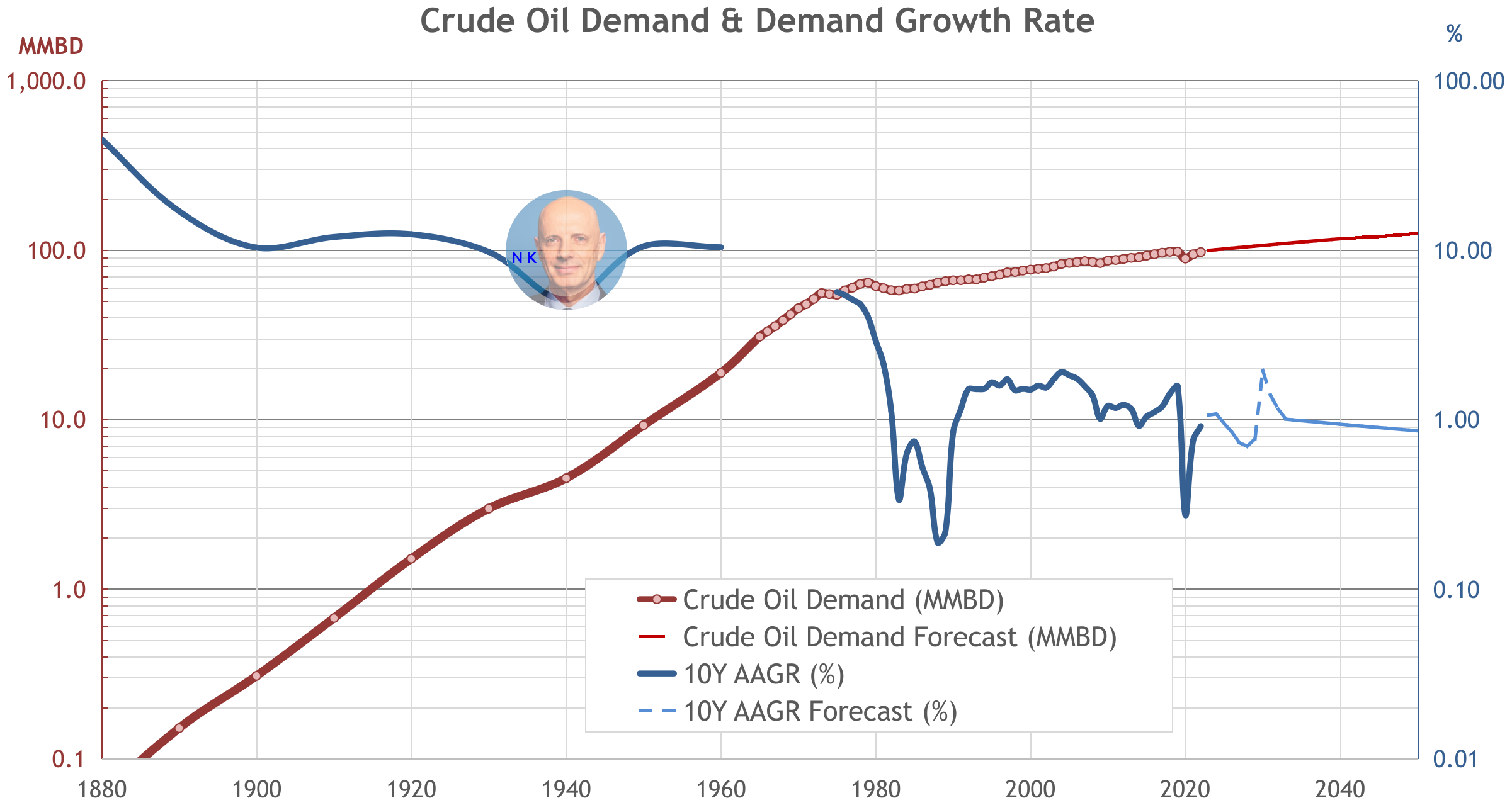

Lindy's Law applied to Crude Oil

Where does oil demand growth stand by contrast❓

As we had correctly anticipated in this 48 sec video published in October 2022, oil demand recovered from its Covid era collapse and growth resumed to now exceed its previous pre-Covid peak value:

"As long as the world’s population continues to increase, and the economy extends its long term growth trajectory, the world will consume more crude oil with an expected average increase of one million barrels of oil per day year after year for decades come, as there is no economically viable and technically suitable short term substitute."

Based upon the Energy Institue demand data, oil demand was 97.31 Million Barrels per Day (MMBD) in 2022 and according to the IEA quoted above, 2.2 MMBD were added in 2023 and one more MMBD will be added in 2024, then we can calculate that oil demand reached 99.51 MMBD in 2023 above the 2019 peak value of 97.96 MMBD, and it is expected to surpass 100 MMBD in 2024. To be conservative we are adding one MMBD per year starting in 2024 until 2050, which indeed corresponds to a diminishing growth rate over the period since 1 MMBD from e.g. 110 MMBD is lower than 1 MMBD from 100 MMBD. This is reflected in the 10-Year Average Annual Growth Rate (AAGR) decline of oil demand calculated since 1880 and extrapolated from 2023 to 2050.

110 MMBD is as well the peak oil demand value of Goldman Sachs quoted above, which fits with our extrapolated oil demand in of 110.51 MMBD in 2034, with the nuance that beyond that date, we do not foresee a decline but a steady growth in oil demand that is expected to reach above 126 MMBD in 2050.

|

There is in fact no rational justification for oil demand to decline, rather to the contrary, absent a major global economic crisis, a third (nuclear) world war or a cataclysmic event (think of a volcanic super-eruption resulting in a solar winter, a major meteoric impact or a global cooling event), which by the way would affect any other human or economic activity, or energy system including solar and wind energy.

This 1 MMBD yearly addition to crude oil demand corresponds to 588 TWh, just above the 550 TWh of energy generation from wind and solar added in 2023. Nothing can break the back of an almost 170-year old, extremely sophisticated industry that provides the bulk of the fuels, lubricants and chemicals the world consumes.

Lindy's Effect anyone❓

Refining Juggernauts

As mentioned in the video posted above:

"But crude oil is unusable as such, it needs to go through the obligatory step of separating it into various fractions through distillation, to make gasoline, kerosene, gasoil, and fuel oil, a process better known as refining."

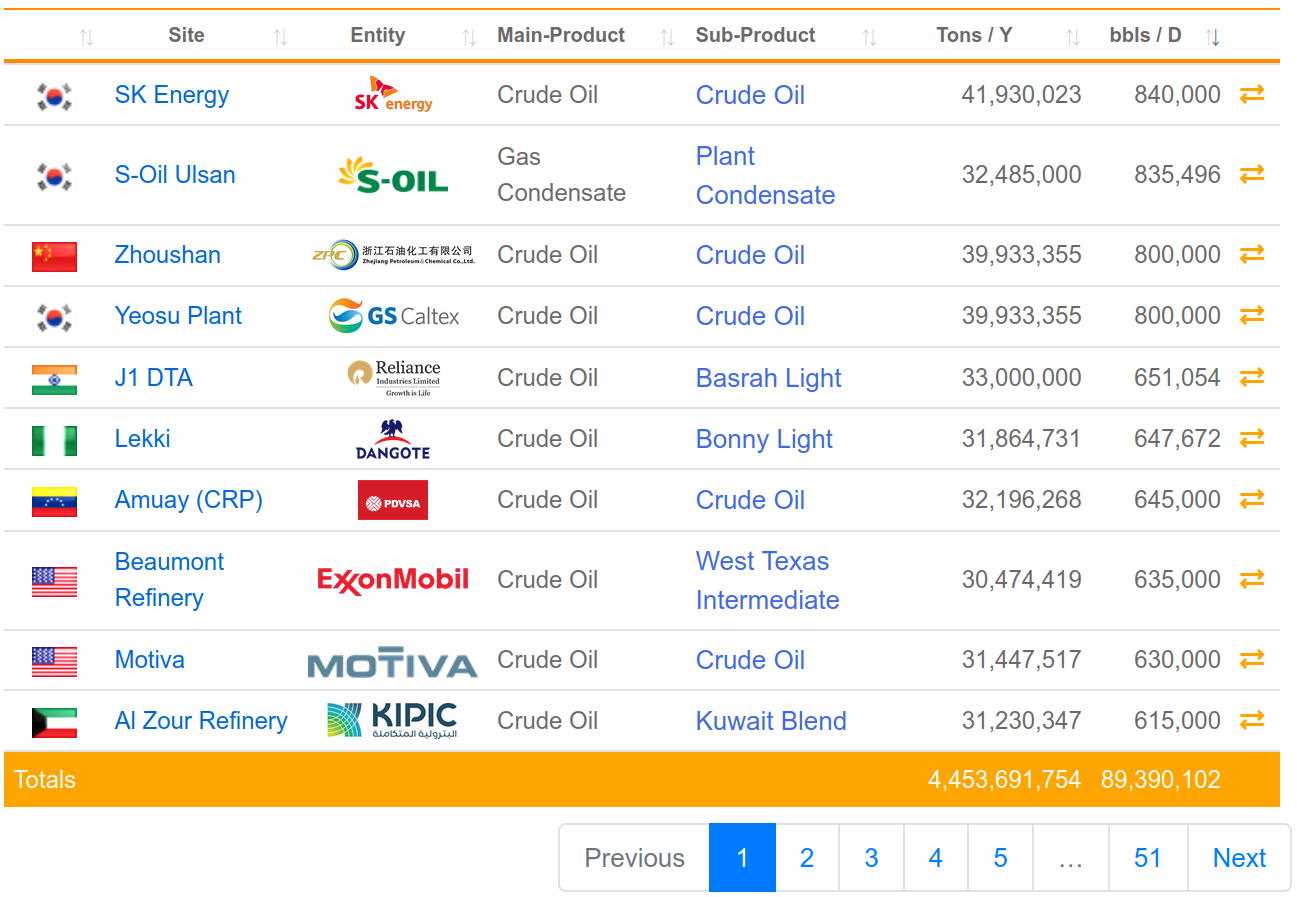

This leads us to determine the challenges the refining industry is facing in terms of refinery build-up. The largest refineries in the world are reaching a crude processing capacity of 900 Thousand Barrels of Oil per Day (MBD), an information available from the portfolio planning PLUS Refining Module:

|

The largest refineries in the world reach of exceed 800 MBD of annual crude processing capacity, such as SK energy's Ulsan complex, S-Oil's Ulsan refinery and GS Caltex' Yeosu plant, all of them in South Korea, as well as the Zhejiang Petroleum & Chemicals Company Ltd. refinery in Zhoustan, PRC.

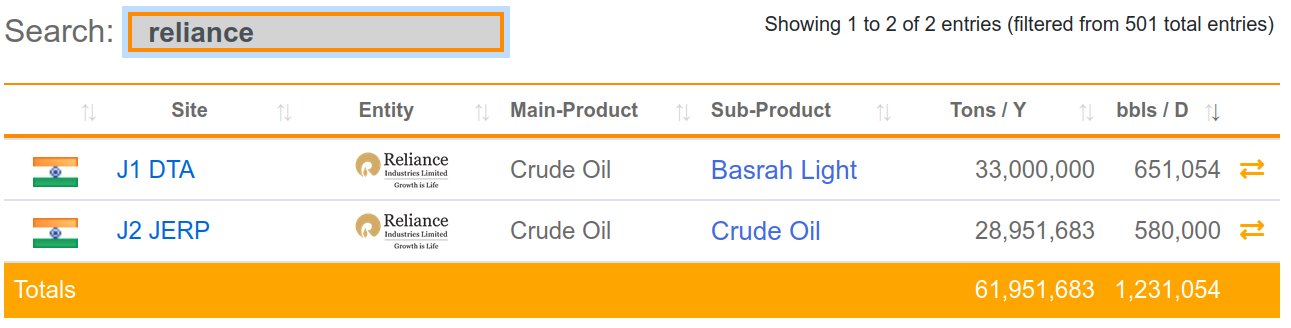

Reliance's Jenmagar is commonly reported to be the largest global refinery, but it is in fact a giant integrated hub of two large scale refineries developed in stages on adjacent areas, each sporting a capacity of around 600 MBD for a cumulated total of 1,24 MMBD.

|

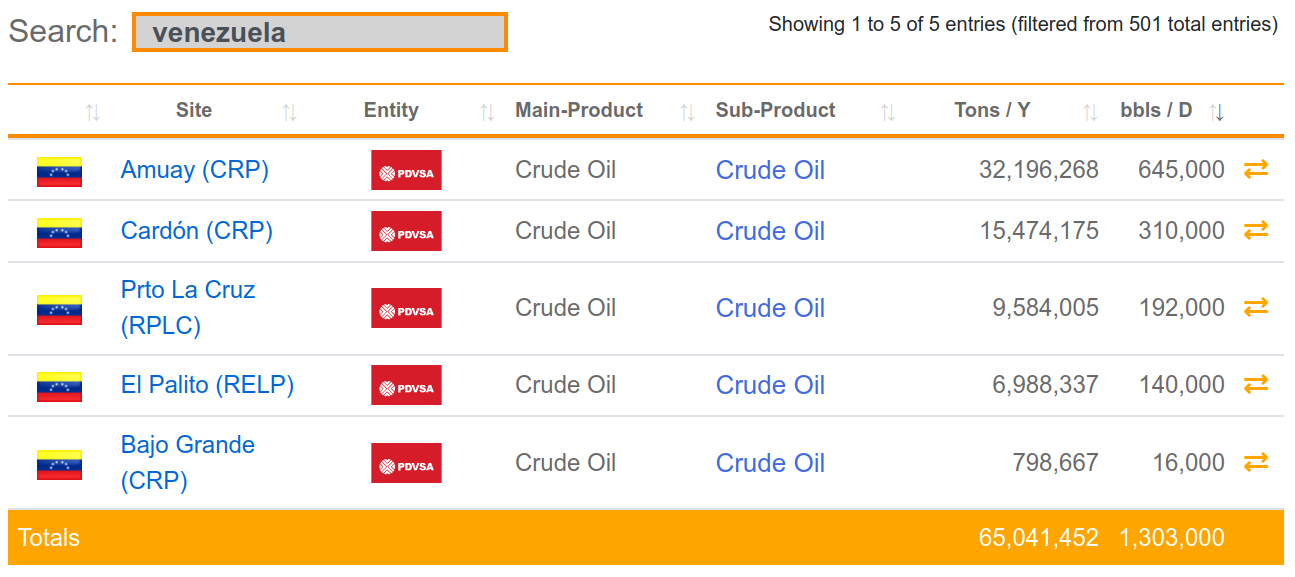

By the same token, PDVSA's Paraguana Refining Center is also considered the second largest refinery in the world but it is also made of two large scale refineries, Amuay and Cardón, situated on opposite sides of the local community with a cumulated total processing capacity of 955 MBD.

|

Same applies as well to the Adnoc's Ruwais refining complex, made in fact of two refineries built in 1982 and 2014, Ruwais East and Ruwais West Refineries..

The module shows that there are less 20 sites that can be considered to be mega-refineries with a refining capacity of 500 MBD or above, a similar number of refineries with a refining capacity from 400 to below 500 MBD, about 40 refineries in the 300 to below 400 MBD refining capacity range, and more than 100 refineries with a refining capacity from 200 to below 300 MBD.

As newer refineries are getting developed, they are mostly mega projects designed for economies of scale in the upper half of the capacity range above 500 MBD where largest scale technologies are being deployed, such as the largest pipeline infrastructure, the largest distillation column, the larfest FCC, the largest steam cracker, etc... The scale of the projects deployed in the last 10 years is simply mesmerizing, revealing accelerated consolidation of the industry, from oil producers to chemical manufacturers via technology companies and engineering firms.

Refinery Obsolescence

At the other end of the scale there are about 170 refineries with a capacity of 100 MBD to below 200 MBD, and still more than 140 refineries with a refining capacity lower than 100 MBD, summing up to 310 small size refineries but representing 62% of the total number of refineries.

As new mega-refineries are being built, there is a continuous wave of decommissioning of older and smaller refineries becoming unprofitable or obsolete due to low scale, low efficiency, disconnection from their historical feedstock sources, or the loss of their regional customers. In the aggregate, refinery decommissioning may amount presently to the size of one of the largest global refineries or about 800 MBD of refining capacity every year.

Not the Last, Nor the Penultimate Wave of Refinery Construction

Summing up the forecasted average yearly demand increase for crude oil (1 MMBD) and decommissioned refining capacity, there is a total of 1.5 to 2 MMBD of required, incremental new-built or revamping refining capacity that needs to be deployed every year over the next 25 years, which corresponds to an average of two largest scale refineries (800 MBD) or about six medium size refineries (300 MBD). Over the same time period, the total number of refineries will shrink considerably as well as a larger number of small plants will be decommissioned.